Passive income streams are attractive to many individuals because they offer a way to earn money without having to trade time for it. This means that even while you're sleeping, on vacation, or pursuing other interests, passive income can continue to flow in. Here are some additional ways to generate passive income:

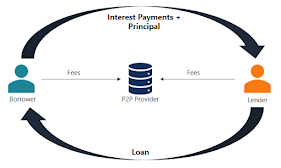

Peer-to-Peer Lending

Peer-to-peer lending is a form of investing where individuals loan money to other individuals or businesses, often through an online platform. The investors earn interest on the loans they make, which can provide a steady stream of passive income.

While peer-to-peer lending can be a relatively low-risk way to generate passive income, there are some risks involved. Defaults on loans can result in a loss of investment, and there is often limited protection for investors in case of borrower defaults.

|

| This is the step that how we lend money to our peers !!! |

Royalties from Intellectual Property

If you have a creative side, you may be able to generate passive income through royalties from intellectual property. This can include patents, trademarks, copyrights, and even licensing deals for software, music, or artwork. While royalties can provide a steady source of passive income, it can take significant time and effort to create and market intellectual property. Additionally, intellectual property rights can be complex, so it's important to consult with a lawyer to ensure that your rights are protected. Passive income streams are a popular topic in the world of personal finance, as they offer a way to generate income without having to work actively for it. This blog will explore three popular types of passive income streams: real estate, dividend stocks, and online businesses.

Real Estate

Real estate investing has long been a popular choice for generating passive income. This can take the form of rental properties, vacation homes, or even flipping houses. The benefits of real estate investing include regular cash flow, a potential appreciation of the property, and tax advantages such as depreciation deductions. One common way to invest in real estate is through rental properties. By purchasing a property and renting it out, investors can generate regular monthly income from rent payments. While there are expenses associated with owning and maintaining a rental property, such as property taxes, insurance, and repairs, the income generated can be significant. Another way to invest in real estate is through real estate investment trusts (REITs). REITs are companies that own and operate real estate properties, such as shopping centers, apartment buildings, and office buildings. By investing in a REIT, investors can receive regular dividend payments and potentially benefit from the appreciation of the properties owned by the REIT.

|

| Real-Estate is the most common form of earning money for an individual |

Dividend Stocks

Dividend stocks are another popular choice for generating passive income. Dividend stocks are stocks that pay regular dividends to their shareholders, usually on a quarterly basis. The amount of the dividend payment is determined by the company's board of directors and can vary depending on the company's financial performance. Dividend stocks can provide a reliable source of passive income, as they often pay higher yields than traditional savings accounts or bonds. Additionally, dividend stocks can provide the potential for long-term capital appreciation, as the value of the stock may increase over time.

Online Businesses

In recent years, online businesses have become a popular way to generate passive income. Online businesses can take many forms, such as e-commerce stores, affiliate marketing websites, or even digital product sales. One benefit of online businesses is the ability to generate income from anywhere in the world, as long as there is an internet connection. Additionally, online businesses often have lower overhead costs compared to traditional brick-and-mortar businesses, as there is no need to pay for rent or utilities. However, it's important to note that building a successful online business takes time and effort. While it may provide a source of passive income in the long term, it often requires significant upfront investment in terms of time and resources.

|

| It is great to start an online business, as an individual would learn about the problems and with business he could have a solution. |

Conclusion

Passive income streams can provide a valuable source of income for those looking to generate additional cash flow without having to actively work for it. Real estate, dividend stocks, and online businesses are all popular choices for generating passive income, each with its own benefits and potential drawbacks. When considering investing in any of these passive income streams, it's important to conduct thorough research and consult with a financial advisor to ensure the investment aligns with your goals and risk tolerance.

.jpg)

Comments

Post a Comment