Inside the Billion-Dollar Playbook: Bain Capital’s Winning Business Strategy Unveiled

Bain Capital has established a reputation for unparalleled strategic skill in the high-stakes world of international finance, where billion-dollar transactions have the power to create or destroy empires. This private equity giant, which is well-known for its astute investing sense and audacious acquisition strategies, has revolutionized businesses in a variety of sectors by fostering innovation, accelerating growth, and unlocking value in a way that no other company has. However, what precisely is the key to Bain Capital's steady success?

Every significant financial decision is supported by a master plan, a business strategy painstakingly crafted to find high-potential assets, improve their performance, and generate returns that outperform the market. The strategy used by Bain money focuses on long-term value creation, transformation, and vision in addition to money infusion. Their business strategy ensures that every investment is in line with their high-impact, high-return ethos by fusing rigorous analysis with extensive operational experience.

In this blog, we pull back the curtain on Bain Capital’s billion-dollar playbook. From its origins in Boston to its global presence today, we’ll explore how the firm chooses investments, scales businesses, and stays ahead in a constantly evolving economic landscape. Whether you’re a budding entrepreneur, an investor, or simply curious about how elite financial firms operate, this is our insider look into one of the most powerful engines of global private equity success.

Vision and Mission: Long-Term Value Creation

At the core of Bain Capital’s operations lies a bold and unwavering vision: to create lasting value across industries and geographies. Unlike firms that chase short-term profits, Bain Capital is committed to building sustainable businesses that deliver consistent performance over the long haul. Their vision is rooted in transformation—elevating the potential of every company they invest in and turning good businesses into great ones through strategic partnerships, operational improvements, and innovative thinking.

The firm's mission is clear and action-driven: to align deep industry expertise with disciplined investment strategies to unlock untapped potential. Bain Capital doesn’t just provide capital—it brings in teams of seasoned professionals who work alongside management to identify growth opportunities, streamline operations, and execute bold turnaround strategies. This hands-on, collaborative approach is what sets Bain Capital apart in a crowded field of investors.

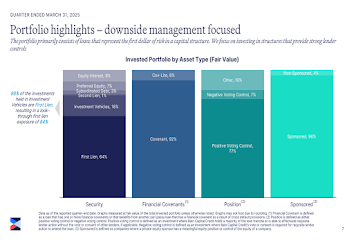

Bain Capital’s commitment to long-term value creation is also reflected in its diversified investment portfolio, which spans private equity, credit, real estate, venture capital, and public equity. With a sharp focus on innovation, ESG (Environmental, Social, and Governance) principles, and stakeholder engagement, the firm continues to lead with purpose. This mission-driven framework not only maximizes returns but also fosters responsible capitalism—proving that business success and positive societal impact can go hand in hand.

Investment Philosophy: Value Through Transformation

Bain Capital’s investment philosophy revolves around a powerful principle: creating value through transformation. Rather than simply acquiring companies and hoping for returns, Bain Capital actively seeks out businesses with untapped potential—those that can be reshaped, reimagined, and reinvigorated to achieve greater success. The firm believes that real value is generated not just by financial engineering, but by strategic and operational enhancement that drives sustainable growth.

What sets Bain Capital apart is its deep operational involvement. The firm partners closely with management teams to identify inefficiencies, implement data-driven solutions, and introduce cutting-edge practices that optimize performance. Whether it’s expanding into new markets, enhancing digital capabilities, or refining supply chains, Bain Capital’s hands-on approach transforms companies from the inside out. This commitment to active value creation ensures that each investment becomes more competitive, resilient, and profitable over time.

Moreover, Bain Capital’s transformation-driven model is supported by rigorous analysis and sector-specific insights. The firm leverages its global network and decades of consulting expertise to craft tailored strategies for each portfolio company. This disciplined, research-intensive process minimizes risk and maximizes impact—ensuring that every move is intentional, calculated, and aligned with long-term objectives. Through this approach, Bain Capital doesn’t just invest in companies—it builds industry leaders.

Diversified Portfolio: Multi-Sector Mastery

One of the defining strengths of Bain Capital is its highly diversified investment portfolio, which spans across industries, geographies, and asset classes. This strategic diversification is not just a safety net—it’s a competitive advantage. From consumer goods and healthcare to technology, finance, industrials, and real estate, Bain Capital’s multi-sector mastery allows it to identify unique growth opportunities and spread risk effectively, even in volatile market conditions.

This broad investment horizon is powered by specialized teams with deep sector expertise. Each team focuses on understanding the nuances of their industry—emerging trends, regulatory environments, customer behaviors, and technological advancements. This insight-driven model enables Bain Capital to not only invest in high-potential businesses but also to guide them with precision and confidence through complex transformations. Whether it’s a fast-scaling tech startup or a legacy healthcare brand in need of revitalization, Bain Capital knows how to unlock value.

Beyond private equity, the firm actively operates in credit, venture capital, impact investing, and public equity. This cross-platform capability enhances Bain Capital’s ability to adapt and innovate, no matter the economic climate. It also allows the firm to offer tailored financial solutions to a diverse array of businesses and investors. This multi-pronged approach has helped Bain Capital build a global presence and a rock-solid reputation as a firm that understands the future of business across every major sector.

Core Business Model: Operational Excellence + Financial Engineering

At the heart of Bain Capital’s success lies a hybrid business model that fuses operational excellence with sophisticated financial engineering. Unlike traditional investment firms that rely primarily on capital deployment, Bain Capital adopts a hands-on, value-creation approach. It partners with portfolio companies to drive operational improvements—enhancing productivity, reducing costs, and scaling efficiently. This commitment to operational transformation is a cornerstone of the firm’s ability to consistently generate above-market returns.

Bain Capital’s operational expertise is drawn from its deep roots in management consulting through Bain & Company. The firm applies proven frameworks, data analytics, and real-time performance monitoring to diagnose challenges and implement impactful solutions. Every move is backed by strategic insight, whether it's revamping supply chains, optimizing pricing strategies, or upgrading digital infrastructure. This approach ensures that Bain’s investments not only survive market pressures but thrive through agility and innovation.

Complementing this operational edge is smart financial structuring. Bain Capital uses financial engineering to responsibly leverage assets, improve cash flow, and increase returns on equity—while carefully managing risk. Through mechanisms such as recapitalizations, debt optimization, and dividend recap strategies, the firm creates financial flexibility that fuels growth and maximizes value extraction. The synergy between operational execution and financial strategy is what truly defines Bain Capital’s unique and highly effective business model.

📊 Market Size: A Global Investment Powerhouse

💼 Notable Investments: Diverse Portfolio Across Sectors

Bain Capital has a rich history of investing in companies across multiple industries. Some of its notable investments include:

-

Emcure Pharmaceuticals: An Indian pharmaceutical company focusing on domestic branded generics and global exports. Bain Capital Private Equity

-

Engineering Ingegneria Informatica S.p.A: An Italian firm specializing in software development and digital platforms for public and private sectors. Bain Capital Private Equity

-

EnterpriseDB: A leading provider of enterprise software and support for the PostgreSQL open-source database ecosystem. Bain Capital Private Equity

-

Envestnet: A provider of integrated wealth tech software and solutions for financial advisors and institutions. Bain Capital Private Equity

Additionally, Bain Capital Ventures, the firm's venture capital division, has invested in companies like DocuSign, LinkedIn, Twilio, and Flywire, many of which have achieved significant growth and successful public offerings.

📈 Investment Returns: Consistent Performance

Bain Capital has established a formidable reputation for delivering consistently high investment returns across its diverse portfolio. With an asset base of approximately $185 billion under management, the firm’s performance is underpinned by a disciplined investment approach and a strong commitment to operational value creation. Over the decades, Bain Capital has demonstrated its ability to outperform market benchmarks by identifying undervalued assets, improving their fundamentals, and executing timely exits to maximize investor returns.

One of the standout examples of Bain Capital’s performance is seen in its earlier years under Mitt Romney, where the firm achieved an astounding average internal rate ofreturn (IRR) of 113% on realized investments. Even beyond those early successes, the firm has maintained a track record of delivering annual returns in the range of 20–80%, depending on the asset class and market conditions. Its venture capital arm, Bain Capital Ventures, has backed high-growth companies such as LinkedIn, Twilio, and DocuSign—many of which went on to become market leaders with successful IPOs.

In addition, publicly traded arms like Bain Capital Specialty Finance (BCSF) have reported steady ROI figures, with a 5.26% return on investment as of March 2025—a solid performance in a competitive credit market. This consistent profitability is a direct result of Bain Capital’s dual-engine strategy that combines deep operational improvement with intelligent financial structuring. Whether it’s through leveraged buyouts, growth equity, or credit investments, Bain Capital continues to prove that its commitment to transformation delivers not just promise—but performance.

Bain Capital Strategy's in financial matters

Bain Capital’s financial strategy is a masterclass in precision, discipline, and innovation, carefully designed to optimize capital deployment while managing risk. The firm employs a multifaceted approach that combines strategic capital allocation, rigorous due diligence, and sophisticated financial engineering to create superior returns for its investors. Unlike firms that simply inject funds and wait for outcomes, Bain Capital takes an active role in shaping the financial architecture of its portfolio companies, ensuring robust capital structures that support growth and resilience.

A cornerstone of Bain Capital’s financial strategy is its expertise in leveraged buyouts (LBOs). By using a combination of equity and debt financing, the firm enhances returns while carefully balancing leverage to avoid excessive risk. Through smart debt structuring and refinancing, Bain Capital ensures portfolio companies have the financial flexibility to invest in innovation, expand operations, and navigate market challenges. This disciplined use of leverage is a key driver of the firm’s consistent ability to multiply investor capital over time.

In addition, Bain Capital’s strategy emphasizes cash flow optimization and capital recycling. The firm focuses on improving operational efficiency to boost free cash flow, which then enables dividend recapitalizations or reinvestments into high-impact growth initiatives. Furthermore, Bain Capital employs an agile exit strategy, timing divestitures to capture maximum value through IPOs, strategic sales, or secondary buyouts. This dynamic approach to financial management allows Bain Capital to maintain strong liquidity, deliver consistent distributions, and continuously fuel its investment pipeline.

Comments

Post a Comment